Returned Mail can be called a silent thief because it causes unnecessary expenses and it’s a business problem that no one wants to talk about. We’re here to change that and make sure that organizations understand the full implications of returned mail and how to overcome them.

5 Ways Returned Mail is Impacting Your Organization

The costs and headaches of managing returned mail add up quickly. Here are some of the situations organizations struggle with:

- Revenue At Risk

- Payments in Returned Mail

- Unhappy Customers

- Unnecessary Expenses

- Increased Credit Risk

Out of the five listed above, how many are impacting your organization?

Revenue at Risk

A significant portion of returned mail is undelivered bills for active accounts. When bills aren’t delivered, those accounts are at risk for non-payment. But before you can accurately measure the impact and determine how much revenue is at risk, you need to know how much returned mail you are receiving. Read the eBook, "Returned Mail: The Silent Thief" to unlock the equation below to estimate how much of your total outbound mail is returned undeliverable.

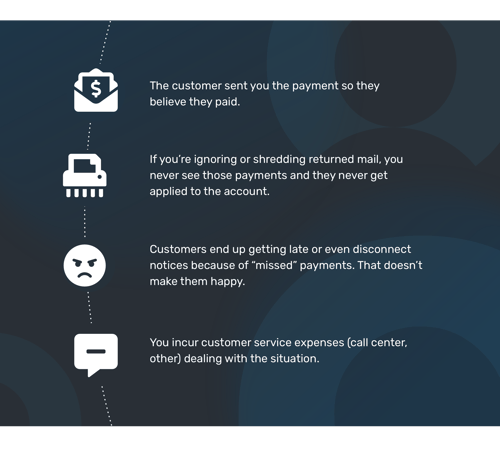

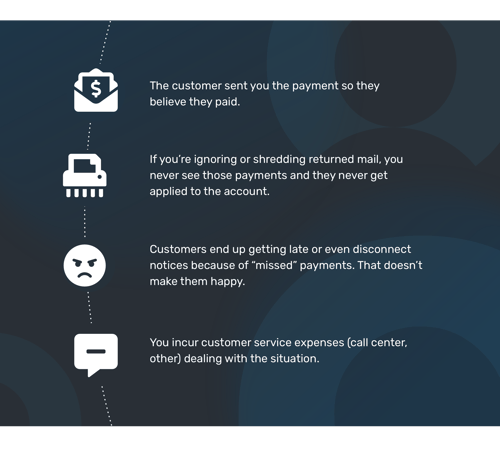

Payments in Returned Mail

It’s not actually the USPS returning mail that contains payments back to the customer. Rather, it’s your customers accidentally mailing payments to your return address. Most consumers don’t know the difference between a remit address (your lockbox or payment processing) and the return address (visible on correspondence they receive). More often than you would imagine, customers put their payment in an envelope and send it to your return address. This results in lost payments, lost revenue, and customers receiving overdue notices in error.

Unhappy Customers

Returned mail often leads to poor customer experience. This happens in a number of ways. Returned mail containing customer payments, for example, not only costs you revenue – those unprocessed payments trigger a chain of miscommunication that in turn creates frustrated, angry customers. Consider the following scenario to see how that happens. Bad account information can also result in customers not receiving your billing and other important notices.This kind of disruption in communications can confuse or alienate customers and cause your organization to lose business.

Bad account information can also result in customers not receiving your billing and other important notices.This kind of disruption in communications can confuse or alienate customers and cause your organization to lose business.

Unnecessary Expenses

It’s common for multiple pieces of mail to be sent to the same address, even after it has been flagged as previously being returned undeliverable. Since each piece of mail costs material, labor, and postage the cost adds up fast!

Increased Credit Risk

A significant amount of returned mail is due to accounts where the problem cannot be fixed. Is the first piece of mail you send to a newly established account returned undeliverable? This clue could indicate fraudulent account holder information. Does an account suddenly begin experiencing mail returns from an address that was previously good? Has something changed? Are they now unlikely to pay? If you ignore these red flags, you’ll continue to extend service (credit) that may never be paid for. That means increased collection costs and potential write-offs.

If you’re concerned about your Returned Mail processes (or lack thereof) you'll should read a copy of our eBook, Returned Mail: The Silent Thief. Inside you’ll find out why outbound mailing processes aren’t enough and how to strategically act when you identify problem accounts.

You can also learn more about Redsson’s Returned Mail solutions here.

Bad account information can also result in customers not receiving your billing and other important notices.This kind of disruption in communications can confuse or alienate customers and cause your organization to lose business.

Bad account information can also result in customers not receiving your billing and other important notices.This kind of disruption in communications can confuse or alienate customers and cause your organization to lose business.